Previous Practice Statement Letter

IMPORTANT INFORMATION FOR CUSTOMERS

The information below does not affect your responsibility to carry on making your normal payments in respect of outstanding loans.

- Our records show that you had or may currently have a loan or guarantee of a loan with Amigo Loans Limited (Amigo). Recently, we've received lots of complaints from customers (mostly from those who've had loans they may not have been able to afford because we did not carry out the right checks when we made the loan).

- We are trying to contact all past and present customers who received loans from us, or who guaranteed a loan. If you have a claim, we may owe you compensation. If you think you have a claim, this letter tells you what you need to be aware of in order to make a claim.

- As there are lots of customers who received loans from us or who guaranteed loans, we don't have enough money to pay the full amount of compensation to everyone who might have a valid complaint. Because of this, we are using a legal process called a Scheme of Arrangement (the Scheme) to ensure we treat all customers fairly.

- The Scheme will make a certain amount of money available to pay compensation to customers who have a valid complaint. We will be asking the Court to call an online meeting to allow creditors to vote on the Scheme in late-April 2021. Creditors who can vote on the Scheme include: (i) customers who believe they have a claim against Amigo, Amigo Management Services Ltd or Amigo Holdings PLC; and (ii) the Financial Ombudsman Service (the FOS) in respect of outstanding fees owed by Amigo. Other creditors of Amigo such as, its secured creditors (i.e. its lenders) or other unsecured creditors (i.e. landlords, local councils and other trade creditors) are not included in the Scheme and will therefore not get to vote on it.

- The Scheme is being proposed without the support of the Financial Conduct Authority (the FCA). Further detail on the FCA's position on the Scheme is set out below in paragraph 7 of this letter.

- If the creditors vote in favour of the Scheme, it will then also need to be approved by the Court. If it is approved by the creditors and the Court, you will then have six months from when the Scheme becomes effective (expected to be in mid-May 2021) to make a claim. If you don't make a claim within the six-month timeframe, you won't be able to make one (even if you didn't think you had one before the deadline).

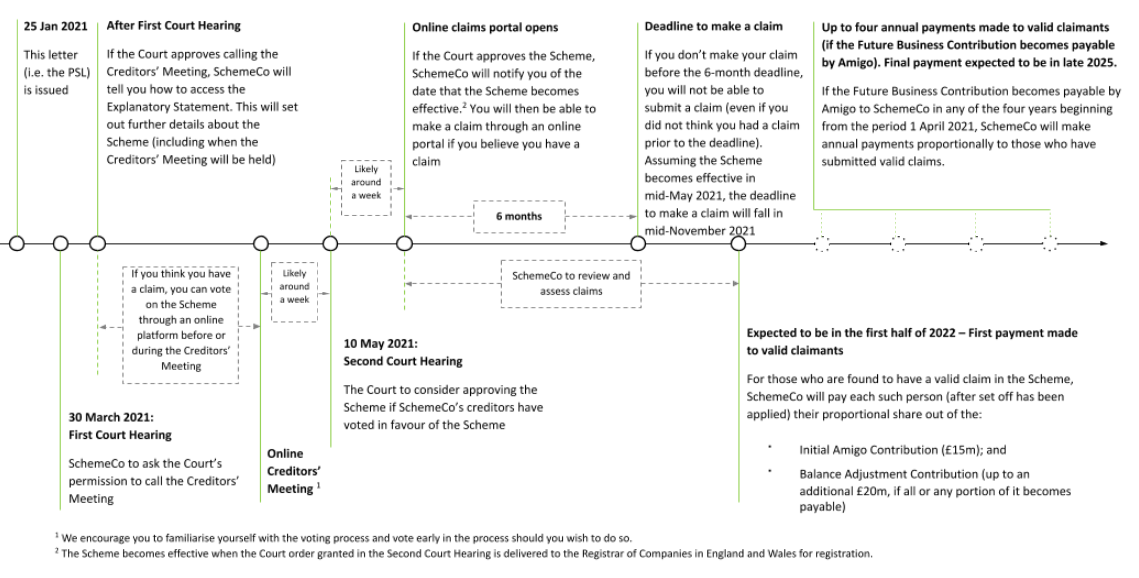

- Once all valid claims have been agreed, we will divide the money we have among customers with a valid claim and the FOS. We expect to start making payments to customers and the FOS in the first half of 2022. We've put a timeline at the end of this letter to show you: (i) the process; and (ii) when you need to take action.

- We only have a limited amount of money and, until we know how many valid claims have been made, it's not possible to say how much compensation customers will receive. We also need to check if you have any outstanding loans. If you have an outstanding loan, your balance will be reduced by the amount of compensation you are owed (known as 'set off').

- The Scheme initially has a guaranteed amount of £15m to pay valid claims (which could be further increased by an additional £20m maximum). Further payments in addition to the £15-35m may also be made depending on the performance of the business (given that Amigo intends to continue to trade). There's more detail about the Scheme funds at paragraph 18. We believe that the Scheme will not be able to pay valid claims in full. As an example, if a customer had a valid redress claim for £1,000 after set off had been applied, and if: (i) the Scheme fund is £15m; and (ii) we receive valid claims worth £150m, then customers may receive £15m/£150m or 10% of their claim, which would amount to a return of £100. Whereas, if a customer had the same redress claim for £1,000 after set off had been applied, and if: (i) the Scheme fund is £35m; and (ii) we receive valid claims worth £150m, then customers may receive £35m/£150m or 23.33% of their claim, which would amount to a return of just over £233. The above examples are not intended to act as an estimate of the amount of compensation that may be payable under the Scheme, which may be more or less, depending on the number of valid claims received. In both of the above examples, because there is a valid redress claim under the loan, a guarantor of the loan would not be required to make any future payments under their guarantee.

- If the Scheme is not approved, Amigo will likely go into insolvency, and based on our calculations, no compensation would be paid to customers. Based on our calculations, customers will be better off if: (i) they vote for the Scheme; and (ii) the Scheme is approved by the creditors and the Court, because they will receive some compensation for their valid claims.

- We expect to notify you again in early April 2021 (in the same way that we have notified you about this letter) explaining how to vote on the Scheme. Please read the rest of this letter which explains the Scheme in more detail. If you have any questions, then please contact us using the information provided in paragraph 37 of this letter.

- Whilst in due course it may be necessary for SchemeCo to confirm your bank details, we will provide you with specific guidance about the process we will use to ensure that these details are obtained in a safe and secure manner. For customers with internet access, we expect to use a secure web portal with strict security arrangements. In the meantime, do not give anyone purporting to be from Amigo or SchemeCo your bank details, and please refer to the guidance contained in the following link about how to protect against scams or fraud https://www.fca.org.uk/consumers/protect-yourself-scams .

PROPOSED SCHEME OF ARRANGEMENT IN RELATION TO ALL SCHEME LTD

The information below does not affect your responsibility to carry on making your normal payments in respect of outstanding loans.

This document describes a proposed Scheme of Arrangement that would affect your rights against Amigo Loans Ltd[1], Amigo Management Services Ltd[2] and Amigo Holdings PLC. You should read it carefully. If there is anything you don't understand, you should seek legal advice.

[1] Formerly known as 1st Choice Party Hire Limited, Loan Line Ltd and Financial Processing UK Ltd (which traded as "FLM" and "FLM Quick").

[2] Formerly known as FLM 001 Ltd and FLM Management Services Limited.

- 1 Amigo Holdings PLC (Holdings PLC) has set up a new subsidiary ALL Scheme Ltd (SchemeCo), which is proposing a scheme of arrangement with its creditors (the Scheme). Creditors include customers who might have a claim against Amigo Loans Ltd (Amigo), Amigo Management Services Ltd (AMSL) or Holdings PLC. A scheme of arrangement is a special procedure under Part 26 of the Companies Act 2006 (described in more detail at paragraph 17 below). The Scheme will allow SchemeCo to pay compensation to: (i) certain customers of Amigo who have a valid 'redress claim'; and (ii) the Financial Ombudsman Service (the FOS) in respect of outstanding case fees owed by Amigo (the details are below at paragraph 5).

- 2 A Redress Claim is a type of complaint that can be made to Amigo by current and former borrowers or guarantors if they believe that they have a claim in relation to an Amigo loan. The most common type of complaint made by borrowers or guarantors is that they were not able to afford repayments under an Amigo loan (borrowers and guarantors may have or make other complaints as well). Any person who is found to have a valid Redress Claim against Amigo is known as a Redress Creditor.

- 3 We are trying to notify all current and former customers of Amigo because some of you may be eligible to claim redress under the Scheme as a Redress Creditor. If you can claim, then your rights will be affected by the Scheme.

-

4

You will have a Redress Claim under the Scheme if you are or have been any of:

- a a borrower that took out a loan from Amigo that should not have been made because you could not afford to repay it; or

- b a guarantor for an Amigo loan and either: (i) that loan should not have been made; or (ii) you should not have been accepted as a guarantor because you could not afford to make payments; or

- c a borrower or a guarantor of an Amigo loan and you have any other claim that might arise out of, or in relation to, an Amigo loan. When this document refers to loans, it means loans made by Amigo after 28 January 2005 up until before 21 December 2020.

- 5 In addition to the Redress Creditors, outstanding case fees owed by Amigo to the FOS in connection with its review of Redress Claims arising from loans made by Amigo up until before 21 December 2020 (which is also an unsecured claim against Amigo and ranks equally with the Redress Claims), will be included in the Scheme. We have already notified the FOS about the Scheme.

- 6 Amigo is regulated by the Financial Conduct Authority (the FCA). Amigo has been in discussions with the FCA regarding, amongst other things, the Scheme and Amigo's future lending.

- 7 SchemeCo has issued this PSL without the support of the FCA, which has not completed its assessment of the Scheme and its underlying methodology for assessing claims while Amigo and SchemeCo continue to develop its terms and underlying methodology. The underlying methodology for determining claims is a critical component of the Scheme as it is this that will be used to determine whether a claim is valid for the purposes of the Scheme and its amount. Amigo, as an authorised firm, had initially sought from the FCA a "letter of non-objection" to the terms of the Scheme, as has conventionally been the case, in order to demonstrate to a Court that the proposed Scheme has not raised regulatory concerns that might undermine Amigo's and, in turn, SchemeCo's ability to implement the Scheme. The FCA has informed Amigo that it cannot provide a "letter of non-objection" based on the current terms of the Scheme and without having completed its assessment and that the FCA reserves the right to take such action as it may consider appropriate once the terms of the Scheme and its methodology have been finalised, or otherwise. Amigo has now withdrawn its request for a "letter of non-objection" but believes it will be able to implement the Scheme because it proposes to use the time prior to the First Court Hearing (to be held on 30 March 2021 - see paragraph 29 below) to work constructively with the FCA to resolve any concerns which the FCA has. If ultimately the FCA decides to object to the Scheme or take any other action, the board of SchemeCo will have to consider the viability of the Scheme and the Amigo group (including SchemeCo) will have to consider what the options for the Amigo group are at that stage.

- 8 Further, the FCA continues to assess whether Amigo is failing (or is likely to fail) to satisfy the FCA's threshold conditions (minimum standards all authorised firms are expected to meet) and its proposed approach to future lending. In light of the further analysis that the FCA can be expected to complete, the FCA has informed Amigo that there is a risk that the FCA may impose a requirement on Amigo's regulatory permissions which restricts it from continuing its business and which affects SchemeCo's ability to implement the Scheme.

Background to the Scheme

- 9 Amigo is a provider of guarantor loans in the UK and offers access to mid-cost credit to those who, because of their credit histories, are unable to borrow from mainstream lenders. Guarantor loans are loans where a friend or relative guarantees repayment of a loan made to a borrower by Amigo. Amigo's loans were serviced by AMSL and the Scheme will also cover any Redress Claim that may be brought against AMSL. The Scheme also covers any Redress Claim that may be brought against Holdings PLC as the parent of all companies in the Amigo group.

- 10 In order to propose the Scheme, SchemeCo has agreed to become jointly liable for any claims that Redress Creditors and the FOS have against Amigo, AMSL and Holdings PLC. Setting up SchemeCo and the success of the proposed Scheme will enable Amigo to continue to trade (which it intends to do).

- 11 The past year has been difficult for Amigo because of: (a) the economic impact of Covid-19; and (b) a significant increase in the level of customer complaints received.

-

12

As a result, Amigo is not making enough money to pay all of its creditors. Usually,

this would mean that Amigo would have to go into an insolvency process such as

administration or liquidation. If this happened, then in broad terms:

- a the significant amount of debt that is owed by Amigo to its secured creditors would have to be repaid first;

- b a liquidator or administrator would continue to collect your loan balance;

- c if you had both a valid Redress Claim and an outstanding loan balance, 'set off' (described below in paragraph 15) would apply to reduce the amount of your loan balance by the amount of your Redress Claim; but

- d unsecured creditors after 'set off' has been applied - including past or current customers who were owed compensation for a Redress Claim - would, based on our calculations, receive nothing due to the lack of available money after paying, for example, secured creditors.

- 13 However, if the Scheme goes ahead, compensation will be paid to customers who have a valid Redress Claim that relates to an Amigo loan. While we believe that the Scheme will not be able to satisfy valid Redress Claims in full, based on our calculations, any amounts paid will be greater than in an insolvency (where unsecured creditors would receive nothing).

- 14 For a borrower with a valid Redress Claim, the claim will be any interest or costs paid on the loans by the borrower (described in more detail in Appendix One at paragraph 3) after the application of set off, plus 8% p.a. simple interest on these amounts. For a guarantor, the claim will be the full amount of all payments made by the guarantor, plus 8% p.a. simple interest, and the guarantee will not be enforced against the guarantor where the Redress Claim is found to be valid.

- 15 'Set off' means that the amount you owe to Amigo under your Amigo loan will be reduced by the full amount that SchemeCo owes you under the Redress Claim. Where you have a valid Redress Claim in the Scheme, any compensation owing to you will first be set off against amounts owed by you to Amigo under any outstanding loan at the time the Scheme became effective (currently expected to be in mid-May 2021) to determine the total compensation payable. If your Redress Claim is greater than any loan amounts owing by you, you will receive a partial payment under the Scheme in respect of your remaining compensation from the available money SchemeCo holds to pay all valid claims. Payments under the Scheme will be made proportionally based on the total value of valid Redress Claims and the FOS's claim (for both, after set off, where applicable).

- 16 Based on our calculations, the Scheme will result in customers receiving more money than they would if the Scheme is not approved and Amigo simply becomes insolvent. There are more details about this in the next section.

Why is the Scheme being proposed?

- 17 A scheme of arrangement is a legal process which allows a company to enter into a compromise or agreement with its creditors. In order to go ahead, it requires certain percentages of creditors who vote, to vote in favour of the Scheme. The details of these requirements are set out in paragraph 33 below. If the Scheme is approved, it will be binding on those creditors of SchemeCo who are affected by the Scheme. That includes those who decide to vote against the Scheme and those who do not vote at all.

-

18

The purpose of the Scheme is to secure a better return for Amigo's customers than

would be possible if Amigo went into insolvency. The key features of the Scheme, if it

is approved, are that:

- a Amigo will make a minimum of £15m available to SchemeCo (the Initial Amigo Contribution ) to make payments to: (i) creditors who are found to have a valid Redress Claim under the Scheme; and (ii) the FOS in respect of outstanding fees owed by Amigo;

- b the Initial Amigo Contribution will be increased if balance adjustments made to outstanding loans following set off (described at paragraph 15 above) are below the reasonable estimate of £85m. However, some loans are not expected to realise their full value. So, for each £1 by which £85m exceeds the actual gross balance adjustment, Amigo will contribute cash of 38.85p, up to a maximum of £20m, to SchemeCo (the Balance Adjustment Contribution); and

- c based on Holdings PLC's audited annual financial statements, Amigo will pay 15% of the annual consolidated profits before tax for each of the next four years starting from the period 1 April 2021 (after adjusting for the net effect of any change in the provisions or costs for redress relating to loans issued prior to the Stop Date) to SchemeCo, to be shared with creditors who have a valid claim under the Scheme (the Future Business Contribution). Each year's payment will be calculated separately, and, if there are no profits in a particular year, there shall be no payment or deduction for that year. Any payments made in respect of profits made will be paid annually to SchemeCo by when Holdings PLC files its audited financial statements for that year at Companies House.

-

19

If the Scheme is not approved by either SchemeCo's creditors or the Court, Amigo

would likely appoint an administrator or liquidator. In the case of an insolvency,

unsecured creditors (including customers) would receive nothing. This is because:

- a the amount of the Initial Amigo Contribution would be used in full to repay Amigo's secured creditors (its lenders) before all other creditors; and

- b Amigo would not be generating the future business profits (from continuing to trade) necessary to fund the Future Business Contribution.

- 20 The Scheme will therefore, based on our calculations, result in customers and the FOS receiving more money than they would if the Scheme is not approved and Amigo goes into insolvency. The board of directors of Amigo and SchemeCo therefore believe that it is in your best interests to vote in favour of the Scheme. That is why SchemeCo is proposing the Scheme.

- 21 Once the Scheme becomes effective (expected to be in mid-May 2021), Amigo, AMSL and Holdings PLC will not have any further liability for the Redress Claims, and any Redress Creditors will have a claim against SchemeCo only, to be paid from the funds which SchemeCo holds (to the extent of those funds). Those borrowers with both a valid Redress Claim in the Scheme and an outstanding loan when the Scheme becomes effective, will benefit from set off in full (referred to at paragraph 15 above). In addition, where there is a valid Redress Claim in the Scheme, a guarantor of the relevant loan would not be required to make any future payments under their guarantee.

How am I affected by the Scheme?

-

22

You will be able to claim under the Scheme as a Redress Creditor if:

- a you have a Redress Claim;

- b the required percentages of creditors (set out at paragraph 33 below) vote in favour of the Scheme; and

- c the High Court approves the Scheme.

- 23 You will then have six months from when the Scheme becomes effective (expected to be in mid-May 2021) to provide details of your claim through an online portal available at amigoscheme.co.uk. If you don't make your claim before this deadline, you will not be able to submit a claim (even if you didn't think you had a claim before the deadline but decide that you do have a claim after the deadline has passed). Customers who have already submitted details of their claim to Amigo before 21 December 2020 (the Stop Date), and where Amigo had acknowledged receipt, will not be required to provide these details again, but SchemeCo may ask for more information from you during the process (if you have not received an acknowledgment of receipt from Amigo of a previously submitted claim, you will need to provide details of your claim through the online portal available at amigoscheme.co.uk in the same way as all Redress Creditors who claim under the Scheme).

- 24 Once all claims have been made, SchemeCo will review these and decide whether they are valid. If SchemeCo agrees with some or all of your claim, you will be entitled to compensation from SchemeCo and/or a reduction of any outstanding loan that you have.

- 25 If the total value of valid claims is more than the amount of money contributed to SchemeCo by Amigo, the money that SchemeCo holds will not be enough to pay all valid claims in full. If this happens, the money that SchemeCo holds will be used to pay these claims proportionally by reference to the total value of valid Redress Claims and the FOS claim. SchemeCo will hold the money that it receives on trust for the benefit of all creditors that have valid claims under the Scheme.

- 26 If the Court gives SchemeCo permission at the First Court Hearing (explained at paragraph 29 below) to call a meeting of creditors (which will be held online because of Covid-19), we will tell you how to access the Explanatory Statement in early April 2021. The Explanatory Statement is a document that will contain further details about how the Scheme will work (including details about how to vote via the online voting portal at amigoscheme.co.uk).

Who is not affected by the Scheme?

-

27

If you are (or have been) a customer who has already complained about: (i) a loan

made to you by Amigo; or (ii) a guarantee you gave to Amigo, and before the Stop

Date:

- a you had your complaint accepted by Amigo or you had accepted a settlement offer from Amigo;

- b you had received a settlement offer from Amigo dated on or after 21 June 2020, which you did not accept or reject;

- c you have been told that Amigo had accepted an opinion issued by an adjudicator at the FOS in respect of your complaint; or

-

d

you had obtained a final decision in your favour from the FOS and Amigo had not notified you that it intends to ask a court to review that decision,

you will not be affected by the Scheme and will be paid the amount specified in the settlement offer, FOS adjudicator's opinion or FOS final decision in full. Unless you also have a different claim, you do not need to take any action.

- 28 In addition, any other creditors of the Amigo group (including SchemeCo), for example, the secured creditors, will not be affected by the Scheme.

How will: (i) the Scheme be approved; and (ii) claims be made and dealth with?

- 29 The steps: (i) needed to approve the Scheme; and (ii) relating to the making and payment of claims, are as follows:

| First Court Hearing | SchemeCo will ask the Court at the First Court Hearing to call a meeting of creditors who are affected by the Scheme. The meeting will allow creditors to consider, and vote on, the Scheme. You have the right to attend the First Court Hearing, but you don't need to attend unless you want to. The First Court Hearing is expected to be held online on 30 March 2021. |

|---|---|

| The Explanatory Statement | Assuming the Court gives SchemeCo permission to call a meeting of creditors who are affected by the Scheme, SchemeCo will send more detailed information about what the Scheme is about. This information will be contained in a document called the "Explanatory Statement". This will also be accompanied by the legal Scheme document. |

| Creditor' Meeting | The meeting of creditors is expected to be held online, likely in late-April 2021 and we will tell you more about this closer to the time. If you are not able to attend the online Creditors' Meeting, you, or someone acting on your behalf, can submit your vote online either: (i) at the meeting; or (ii) before the meeting, using the online voting portal at amigoscheme.co.uk. There is more detail about the voting process in the next section. You should only vote on the Scheme if you think you have a claim. |

| Second Court Hearing | If SchemeCo's creditors vote in favour of the Scheme (as set out at paragraph 33 below), SchemeCo will ask the Court to approve the Scheme at the Second Court Hearing. The Court will also consider whether the Scheme is fair to SchemeCo's creditors. You have the right to attend the Second Court Hearing, but you don't need to attend unless you want to. This hearing will also be held online, probably on 10 May 2021. |

| Making claims | If the Scheme is approved by the Court at the Second Court Hearing, creditors will have six months from when the Scheme becomes effective (expected to be in mid-May 2021) to make their claim to SchemeCo. If you don't make your claim before this deadline, you will not be able to submit a claim (even if you didn't think you had a claim before the deadline but decide that you do have a claim after the deadline has passed). The Explanatory Statement will set out in detail how you can make a claim. |

| Payment and treatment of claims | SchemeCo will review the claims it receives to decide if it agrees with them. If it agrees, subject to the application of set off (as described in paragraph 15 above), it will make a payment to the relevant creditor. The first payments are expected to be made in the first half of 2022 once all the claims have been reviewed. If a creditor does not agree with SchemeCo's decision in relation to its claim, the creditor can ask an independent third-party adjudicator to review their claim. The adjudicator will then decide whether it should be a valid claim under the Scheme. If any issues arise that need to be resolved in relation to the FOS's claim, the FOS can also refer its claim to the adjudicator for consideration in the same way as the Redress Creditors. |

The proposed voting class at the Creditors' meeting

- 30 Creditors who are able to vote together on whether or not to approve the Scheme are known as a 'class' of creditors.

- 31 All creditors within a class must have sufficiently similar rights against SchemeCo. This is what allows them to be able to consider the Scheme, and vote on it together, as they have a common interest.

- 32 SchemeCo thinks that its creditors form a single class to consider, and vote on, the Scheme. The creditors of SchemeCo who will vote together are: (i) the Redress Creditors; and (ii) the FOS. There is more information in Appendix One that explains why SchemeCo has decided that its creditors form a single class to consider, and vote on, the Scheme together.

-

33

Every creditor of SchemeCo affected by the Scheme has the right to cast its vote at

(or before, via the online voting portal at amigoscheme.co.uk) the Creditors' Meeting.

The Scheme will not go ahead unless:

- a a majority (i.e. more than 50%) of the creditors who vote at the Creditors' Meeting vote in favour of the Scheme; and

- b those creditors who vote in favour of the Scheme, hold 75% or more of the value of all the creditors that vote.

Next steps

- 34 At the First Court Hearing, the Court will decide whether it agrees with SchemeCo that SchemeCo's creditors can vote on the Scheme together as a single class. If the Court agrees, SchemeCo will ask the Court to call a meeting of its creditors to allow them to vote on the Scheme. We will send an email and SMS to customers for whom we have contact details to tell you about the meeting and how you can vote online.

-

35

If you:

- a have a legal objection to the Scheme; or

- b disagree that SchemeCo's creditors can consider, and vote on, the Scheme in the same class; or

- c intend to attend the First Court Hearing, please send details to Freshfields Bruckhaus Deringer LLP at [email protected] before the First Court Hearing and we will bring your objection (if any) to the Court's attention.

- 36 You may also attend the First Court Hearing and make any objection to the Court directly. While you will still be able to object to the Scheme at the Second Court Hearing, the Court will expect you to show good reason why you did not do so before or at the First Court Hearing if the matters were known before that hearing. As the First Court Hearing will be held virtually, you will have to contact us or the Court ([email protected]) to obtain details of how to attend.

- 37 You can find more information about the Scheme at amigoscheme.co.uk. If you have a general question about the Scheme, you can email us at [email protected] or call us on 01202 629798.

Appendix One

Class Analysis

-

1

In order to decide whether its creditors can form a single class for the purposes of

voting on the Scheme, SchemeCo has taken legal advice and has considered:

- a the current rights that each creditor has against Amigo, AMSL and Holdings PLC; and

- b the way in which those rights will be affected under the Scheme.

- 2 The legal test to determine whether creditors can form the same class for the purpose of considering and voting on a scheme is capable of being described in different ways. These include that, objectively: (i) there must be more that unites than divides the creditors in the proposed class; and (ii) the class should consist of those persons whose rights against the company proposing the scheme (in this case, SchemeCo) are sufficiently similar to enable them to properly consult and identify their true interests together.

-

3

Under the current redress regime operated by Amigo, if a borrower or guarantor

claims redress:

- a the guarantor's claim is for the full amount that the guarantor paid, plus 8% p.a. simple interest, and the guarantee will not be enforced against the guarantor where the redress claim is found to be valid;

- b the borrower: (i) only has a claim if they have repaid more than the amount of credit that Amigo lent (the Capital); and (ii) any claim will equal the amount the borrower has repaid in excess of the Capital after the application of set off, plus 8% p.a. simple interest; and

- c if the borrower has repaid less than the Capital, then, if a redress payment is made to a guarantor, the borrower will owe to Amigo the amount of any unpaid Capital that is left as a result of the redress payment made to the guarantor (the Capital Revival).

- 4 The Scheme will replicate the current redress regime of Amigo, except that, only for the limited purposes of the Scheme, there will be no Capital Revival. This will mean that no borrower will be worse off as a result of a redress payment being made to a guarantor under the Scheme.

-

5

SchemeCo has decided that the Redress Creditors and the FOS can form part of the

single class of creditors for the purpose of considering and voting on the Scheme.

The main reasons for this decision are as follows:

- a both the Redress Creditors and the FOS are unsecured creditors with substantially the same rights and equal ranking claims against SchemeCo, Amigo, AMSL and Holdings PLC. If the Scheme does not go ahead, Amigo, AMSL and Holdings PLC will most likely become insolvent and, based on our calculations, Redress Creditors and the FOS, as unsecured creditors, would not receive any payment;

-

b

the Scheme will give Redress Creditors and the FOS similar rights; namely:

- i they will all be able to make a claim in respect of sums they claim are owed to them by Amigo, AMSL and/or Holdings PLC;

- ii their claims will all rank equally (as they did before);

- iii SchemeCo will review their claims;

- iv if SchemeCo disagrees with their claim, they will all be able to refer their claim to an independent third-party adjudicator; and

- v if SchemeCo agrees with their claim, they will all share in the money held by SchemeCo in proportion to the total value of their accepted claims after set off; and

- c the main question for both Redress Creditors and the FOS will therefore be whether to vote against the Scheme and receive nothing in an administration or liquidation scenario or to vote in favour of the Scheme and receive a payment, albeit partial, in respect of their claim under the Scheme.

-

6

SchemeCo does not think that the absence of Capital Revival from the Scheme

affects the class composition. This is because, without the Scheme:

- a Amigo, AMSL and Holdings PLC would mostly likely go into insolvency; and

- b if this happened, a guarantor would not receive any payment, meaning that there would also not be Capital Revival for the borrower.

- 7 SchemeCo is also of the view that any potential differences between Redress Creditors' claims and the FOS's claim in respect of case handling fees (such as the fact that the latter is likely to be for a liquidated and ascertained amount) would not mean that these creditors need to form different classes. These differences would also apply in an insolvency of Amigo, AMSL and Holdings PLC and do not affect the ability of Redress Creditors and the FOS to consider the Scheme, and likely alternative of insolvency, together.

Appendix Two

Visual Aid - Indicative Timeline